One in ten has excessive debt due to the pandemic.

Within a very short time, the Covid-19 pandemic has turned our lives upside down. From a financial perspective in particular, the pandemic forced a lot of people to reconsider planned expenditures or to take on debt just to make ends meet. The Covid-19 Financial Report commissioned by the EOS Group shows that in Germany there are people who slipped into excessive debt over the last year.

One in ten respondents took on debt that they are not able to pay back.

Although the pandemic is a global crisis, every nation and population group is affected differently. Within the scope of the Covid-19 Financial Report, which online poll specialist Dynata conducted on behalf of EOS, 2,000 German consumers provided information about how the pandemic has affected their consumption patterns and debt situation.

"It’s perfectly understandable if people are forced to take on debt temporarily to cover the necessities of life. We are in an exceptional situation and at present, nobody can reliably predict how it will develop."

Single parents and younger people suffering particular financial hardship amid the crisis

Sole parents have been the hardest hit by the pandemic: More than one in four (26 percent) has taken on debt to be able to survive the crisis financially. From a demographic perspective it is also the younger generations that have borrowed money in the course of the crisis. Just under one in five (18 percent of each group) of 18-29 year-olds and 30-39 year-olds said they had acquired debt. By way of comparison: In this context, the age group between 50 and 60 years accounts for just six percent.

It therefore does not seem surprising that it is the younger consumers (18-29) and single parents that have the most pessimistic view of the future: 31 and 39 percent respectively assume that they will need to take on new debt in the coming months. This puts them well above the German average of 19 percent.

Since the outbreak of the pandemic, 12 percent of those polled have ended up with excessive debt.

“It’s perfectly understandable if people are forced to take on debt temporarily to cover the necessities of life. We are in an exceptional situation and at present, nobody can reliably predict how it will develop,”says Andreas Kropp, member of the EOS Group's Board of Directors with responsibility for the German market. For 12 percent of those polled, this has meant that they have slipped into excessive debt since the start of the pandemic and can no longer pay back these debts. Here too, sole parents have been hit hardest, with just under one in four (23 percent) unable to pay back their debts amid the crisis. Looking to the future, 19 percent of German consumers are afraid that they are going to have to take on debt in the next few months.

A look at the international comparison in the report quickly reveals that as far as debt is concerned, consumers from other countries are affected to an even worse extent. 15 percent of respondents in Spain, 19 percent in Croatia, 28 percent in Romania and as many as 32 percent in Bulgaria said that they have incurred debt due to the pandemic.

What is excessive debt?

Excessive debt refers to a situation where the debt incurred by a person or a company exceeds their own assets. In the case of private individuals this is usually preceded by an unexpected event like the sudden loss of a job or a serious illness. However, poor money management can also often result in excessive debt.

Consumer behaviors: Going without vacations, new furniture – and health?

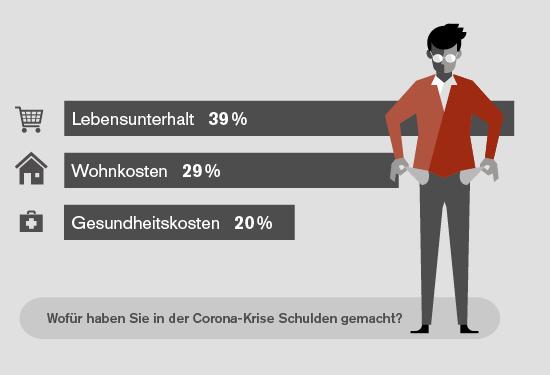

Although a majority of Germans did not assume that they would have to take on debt in the near future, many respondents (65 percent) stated that they had gone without a vacation due to the pandemic. Much smaller numbers of consumers were refraining from spending on items like furniture (21 percent), renovations (19 percent) and consumer electronics (17 percent). Even spending on health (12 percent) and education (12 percent) had to be cut, something that sets off alarm bells for Andreas Kropp: “When financial resources are tight it makes sense to cut your spending on things that are not absolutely necessary. However, if your health suffers as a result, this is a matter of concern.” Nonetheless, one in five respondents said they had not given up anything. With a view to an eventual end to the crisis, the majority of respondents are in agreement: 60 percent of them planned to spend money on a vacation first, and who can blame them?

Download and service

Read more international studies and download the full Chatbot Study report here.

The aim of the Covid-19 Financial Report is to show how consumers in various countries have experienced the pandemic so far. In this context, the focus is on their financial situation and how this has changed in the course of the crisis. What effect did the crisis have on people’s consumption patterns? To what extent and for what reasons did consumers have to take on debt, and were they able to pay it back? To find this out, online polling specialist Dynata surveyed 7,000 people from five European countries on behalf of EOS. As well as German consumers, Spaniards, Romanians, Bulgarians and Croatians also took part in the survey. The results indicate which population group is affected by the crisis and to what extent, and show the kind of personal payment difficulties consumers can reckon with in the future.

If you would like to take a look at the detailed results of the survey please don’t hesitate to contact us!

Daniel Schenk

Head of Corporate Communications & Marketing Germany

EOS in Germany

Steindamm 71

20099 Hamburg

Germany